“Cities have the capability of providing something for everybody, only because, and only when, they are created by everybody.” — Jane Jacobs The Death and Life of Great American Cities

Executive Summary

Overview: The following is a joint report from Internet Association and National League of Cities on the future of cities in the digital economy. The report examines the current state of ‘new economy’ jobs from the Internet sector in US cities and then examines the policies and approaches of four case study cities – Columbus, OH; Kansas City, MO; Phoenix, AZ; and Pittsburgh, PA. Goal: The purpose of the report is to highlight and draw lessons from cities that are actively pursuing a greater integration of technology into their economies, environments, and policymaking. The report specifically looks at ‘up-and-coming’ tech cities rather than more established hubs like Seattle or Silicon Valley.

Highlights and Findings:

- The Internet sector (our proxy for the new economy) has a strong presence across all of America’s major metropolitan areas as measured by number of establishments and employees

- A larger internet sector in a city correlates with higher overall productivity, population, and income levels and lower levels of unemployment and poverty.

- Based on our case studies, the report finds the following general lessons for city leaders and stakeholders:

- Capitalize on cultural and historical assets

- Emphasize economic inclusion

- Have a willingness to experiment with new programs

- Build well-rounded labor markets and diverse economies

- Based on our case studies, the report finds the following specific areas of application for city leaders and stakeholders:

- Transportation systems are critical infrastructure and can greatly and quickly benefit from new technologies

- Open data systems provide win-win opportunities to cities and their citizens; businesses can utilize the data to improve products, services, and efficiency while governments can gain important insights on services and constituents

- Fast pilot projects in procurement systems allow for more rapid development of innovative city services while minimizing the risk from larger scale implementations

- Partnerships are key to achieving policy goals. Governments can often draw on the technical expertise of the private sector while companies can draw on the vision and policy expertise of local leaders to find solutions that help both parties involved.

Introduction

A city is more than a place or geography. A city is a home. A city is a laboratory. It is a confluence of culture and ideas that fundamentally shapes its residents. It projects a history and a reputation to the broader world and influences those that visit it. It offers new experiences, new ideas, and venues to explore them. These aspects become an integral part of the identity of each and every one of its residents, current or past. This report examines the role of cities as innovators. Not in a historical context of bygone eras or past lessons, but rather with an eye toward the future. It looks at the ways in which cities can utilize new technologies to achieve more for their residents. It explores how they address challenges and implement policy solutions in a digital world. It examines how they lead and how they can transform their environments for the better. Using a comparative case study approach, the goal of this report is to highlight and draw lessons from cities that are actively pursuing a greater integration of technology into their economies, environments, and policymaking. We chose four cities – Columbus, Ohio Kansas City, Missouri/Kansas, Phoenix Arizona, and Pittsburgh, Pennsylvania – as innovative models of how places and policymakers can evolve in the dramatically shifting economic and cultural currents of the past two decades. These cities are not the stereotypical ‘tech’ hubs like San Jose (the Silicon Valley area), Seattle or San Francisco and we highlight them here precisely because they are not (yet) regarded as tech powerhouses. Through experimentation and an open-mindedness in policy and development that draws on their historical roles as innovators, these cities are at the forefront of integrating digital technologies and the internet into their ecosystems. While the cities presented here offer only a few examples, the report authors hope policymakers and other stakeholders will look at these and others around the globe for lessons and promising proactices. From the current state of tech in their economies to their visions for the future, we see the cities presented here as leading the charge into the new, technology-driven economy and believe they can offer insights for others. The report does not purport to offer a comprehensive guide to navigating new currents; it simply argues that cities of all sizes and types can and do innovate. And in the digital context – from the perspective of internet and community champions – this innovation and change is less about physical transformations than it is about new approaches to policymaking that recognize the potential of new industries and of new technologies to address generations-old urban issues. The value in this report is twofold. First, it is a reminder that cities are resilient – they can and do adapt. One need only look to the insolvency and dramatic population loss in the 1970s of the now tony New York City to remember that places and perceptions of them change. Second, this report is one of the first to dive into the intersection of the new economy1 and urban policymaking – it is a stepping stone to better understanding how a fundamentally new economic component, such as the internet sector, can fit into our cities, communities, and hometowns. The report begins with some context on cities, their development and their roles as innovators. Next, the report discusses the use of digital tools by cities and the role of the digital/internet economy in localities. This is followed by a case study comparison, which examines each of our model cities, the challenges they have faced and their plans for the future. Finally, the conclusion draws out key lessons for a broader audience using the input from the local policymakers and initiatives we have explored.

Cities and Innovation

2.1 The Drive Of Innovation

Cities drive American innovation. They serve as laboratories for new ideas, incubating approaches to governance, social programs, the application of technology and much more. This role is largely derived from a mindset of experimentation: cities embrace new strategies and systems because they are focused on delivering solutions for community members. That focus on innovation is largely motivated by two factors. First, city leaders are the government officials closest to their constituents. Community members know their mayors and councilmembers; they see them in the grocery store, at their schools, and walking in their neighborhoods. This proximity builds relationships, provides more direct lines of communication and feedback, and ensures their vested interest in the wellbeing of the communities they serve. Second, city leaders are held accountable. As a result of these democratic encounters and the structure of local governance, local leaders face the greatest pressures to govern effectively and meet the needs and demands of their constituents. Simultaneously, they must integrate these priorities into their relationships with their counterparts at the federal and state levels. In many circumstances, city leaders must be creative to surmise new ways forward on the numerous policy and social challenges they face. In this respect, city policymakers have exhibited great leadership through innovation on a range of important areas. In particular, their embrace of smart city technology and the rise of the maker movement – both catalyzed through the innovative conglomeration of space and place with a healthy dash of density – are noteworthy. The relationship is circular – cities drive innovation, but are also driven by it. New technologies and new governance approaches can move cities forward as competitive and desirable places to live. At the same time, cities serve as the proving grounds for new ideas, policies and technologies.

2.2 Smarter Cities

Technology has always been a critical force deeply intertwined with the evolution of cities. From the first human settlements to the industrial revolution to today, technological breakthroughs have shaped cities. They impact the buildings we use, the way we get around and how we live our daily lives in urban spaces. This is seen most clearly in the movement toward smart cities.2 The development of smart cities builds upon this strong historical foundation through the incorporation of digital technologies to allow cities to function more efficiently. Digital tools allow for greater responsiveness to community members and, ultimately, create better and more equitable urban environments where people can thrive. Cities are beginning, and will continue, to integrate dynamic digital technologies into municipal operations, improving everything from transportation systems and infrastructure repair to waste management and public lighting. Beyond the technological components themselves, cities are also utilizing insights gained from these technologies – via data, partnerships, etc. – to launch and improve social programs. As the integration of smart-city technology becomes more visible in our everyday lives, we will continue to see positive changes in our cities, with increasingly rapid shifts in cities precipitated by technology. Take the following examples. Autonomous vehicles on our roadways and the data they provide could create environments where traffic lights become obsolete and traffic itself becomes a thing of the past. Cities can once again be for people rather than cars, as different modes of transportation work in tandem and communicate with each another. As we move toward greater usage of shared vehicles, we can reduce parking needs and enable cities to recapture land for people, while reducing building costs as parking garages become unnecessary. This is more than wishful thinking – the Organisation for Economic Co-operation and Development (OECD) has estimated that autonomous vehicles and ride-sharing could improve traffic efficiency by 90 percent3, maintaining the same number of passengers traveling and commuting within a city area with just 10 percent of the vehicles. Energy sources could be completely renewable in smart cities. Technology will pave the way for better integration into our cities, helping to create a cleaner environment for everyone. Systems can draw on machine learning to collect information from sources such as smart water systems, electric grids, and gas meters, and then optimize them to reduce waste and costs. Repairs can be made as soon as they are needed and not just when or if residents call them in. Through the use of new technology, cities can improve the lives of their residents while achieving broader policy and environmental justice goals. Innovation in the advanced manufacturing space is also making people’s lives better in cities. The maker movement is taking hold in cities through the advent of 3D printers, digital design systems, digital schematics and other technologically-enabled tools (see Window 1). Co-working spaces and freelance systems allow makers to access state-of-the-art facilities and specialized expertise without burdensome overhead costs. The meteoric growth of micro-manufacturers, entrepreneurs, and online platforms like Etsy demonstrates how strongly the movement has taken root and it’s in cities, big and small, where makers are plying their trade. The urban arena is once again the true fulcrum of innovation, serving as the natural meeting place of people, place and prosperity. This path forward is predicated on the adoption and integration of technology into urban place-making and policymaking by cities. That predication implies the need to learn from those cities already making strides in these areas.

Window 1: Development Through Makers

The hyperlocal manufacturing environment of the maker movement holds potential not only for individual hobbyists, but for economic development efforts as well. Communitywide advances in local entrepreneurship and job creation are growing due to the rise of maker spaces, both nationwide and globally. Particularly as we move full circle with the rise, once again, of cities, it is imperative for city leaders to capitalize on the creativity, advanced skill sets and far-thinking ideas of city dwellers for the betterment of our communities. Luckily, this is happening on the ground right now. More policymakers are turning to focused innovation districts within cities to help stimulate development. Innovation districts cluster talent, startups, established firms, nonprofits and cultural assets in places that incubate creativity and serve as labs for far-reaching concepts and policies. Their goal is simple: to cultivate and harness new ideas and technologies. The closed innovation environment of yesterday, where businesses cloistered amongst themselves in suburban office parks, has given way to open environments in cities where ideas can move more freely. We can see this in the numerous announcements from major corporations about their intention to move from suburban office parks to downtown locations, including McDonald’s recent announcement of their move to downtown Chicago.4 A large motivator for these moves is the desirability of cities to workers and the innovativeness of urban areas to companies. Innovation districts bridge gaps and build partnerships across sectors, creating larger ecosystems that foster heightened creativity and technological breakthroughs. They are, in a sense, transforming cities into “innovation hubs.” But these districts are more than just buzzwords – they are manifestations of long-standing economic theory around the externalities of local clusters. The interactions that take place in these areas attract talent, funding and investment and, in turn, help drive the vitality of the city. By amplifying what is great about cities and concentrating on unique and key assets, innovation districts help drive economic growth, bringing people together to develop ideas and create.

2.3 The opportunities and challenges of cities

Throughout history, many American cities have turned to innovation to address challenges, economic and otherwise. For example, the city of Pittsburgh struggled through economic hardship and emerged as a world-renowned leader in technological innovation. In the middle of the 20th century, when many of Pittsburgh’s manufacturing jobs were falling by the wayside, the city was faced with a significant decline in population and an unemployment rate of nearly 18 percent. The city faced the task of reinventing its economy and subsequently established itself as a technology and robotics hub. In another example, the city of Chattanooga, Tenn., was also facing industrial decline when Mayor Andy Berke took steps to tie the city’s future economic success to the innovation economy. Chattanooga was the first mid-sized American city to establish an innovation district. Technology has advanced in great leaps in recent decades as we move forward into what has been oft-termed the “Second Machine Age” or “Fourth Industrial Revolution.” Autonomous vehicles have gone from science fiction to reality – rolling down streets in American cities and globally. The computing power that once flew the space shuttle now fits in the smartphones resting in all of our pockets. These rapid advances have led to increasing data analysis and utilization within our cities in a range of areas from city service delivery to contracting to personnel—and many cities are still just at the cusp of the opportunity that lies before us all. While great opportunity arises from technology, growing challenges will also present themselves. Inequality, in particular, has been a growing issue in the United States for the past several decades and improving equity has subsequently become a key consideration for city leaders. Income inequality and the wealth gap are at outsized levels, with the richest 0.1 percent holding the same amount of wealth as the bottom 90 percent. When examined through a racial equity lens, the disparities become even starker; on average, white families have six times the wealth of African American and Hispanic families. Understanding new technologies have the potential to sharpen these divides, the internet industry has strongly committed to helping address these longstanding issues. And through partnerships, firms can learn from the experience and expertise of cities while policymakers can better learn how new technologies can serve to help ameliorate them. This is where we are now. Unfortunately, the current policy environment at the national level isn’t always focused on or equipped to alleviate these inequities, leaving the challenge to local policymakers. With challenges accelerating due to a changing workforce caused by stagnating industries, automation, and other broad disruptions (and re-creations), finding new solutions has become even more critical for all of us. Through data, we can begin to better understand those challenges and solutions. They tell us that the collective, shared future of our cities is not only defined by the continued growth of the tech and the creative sectors – it’s a future where cities must work assiduously to lift all boats with plans for inclusive economic development. Great places won’t rise from a blank slate; they utilize their unique assets to build up what’s special about the community, rather than seeking to recreate success from elsewhere. Cities are the places where this happens. The key to revitalizing growth all across the country is to uplift the innovation percolating from the ground up,celebrating the innovation success stories and further diffuse them into national policy. City leaders are employing technology to create smarter cities, imbue innovation more broadly through public-private partnerships and deepen entrepreneurial ecosystems with small business creation and start-up activity. Collectively, cities are shaping the next chapter in the story of America.

Measuring Technology’s Economic Contributions in Cities

3.1 Providing context

There is a key dichotomy between cities and the internet sector (aka the digital economy). The former are tangible and measurable things with physical structures, boundaries, records, and other elements that define them. The latter does not formally exist in government economic data even though the vast majority of Americans use the internet and digital tools every day. This is an important distinction to make considering this report is attempting to examine how cities are leveraging the internet sector and digital technology in their policymaking. Thankfully, many stakeholders have long recognized the need to define high tech industries, the digital economy and the internet sector given their increasing economic importance. Internet Association, along with other groups like the OECD, has developed its own methodology for measuring the internet sector within the United States economy 5 and demonstrated the robustness of its estimates.6 Building on this methodological approach, this report can also develop estimates for city areas. Nationally, the internet sector contributed approximately $1 trillion, or about 6 percent, of US GDP, about 3 million jobs (3 percent), and over 231,000 establishments (aka businesses) (3.1 percent) in 2014. From state to state, estimates for the sector’s contribution to employment and the number of establishments range between just over 1 percent to over 7 percent with an average of approximately 2.7 percent for both employment and establishments. Furthermore, the sector’s contributions to productivity, employment share and new businesses have all increased rapidly over approximately the last 10 years. And if the internet sector were formally measured, past research demonstrates that it would be among the largest 20 industries, out of over 100 nationally, and larger than many ‘powerhouse’ sectors like retail, construction, and the auto industry.7 However, our report is interested in cities and how they are interacting with the internet sector and digital economy. Using data from the U.S. Census Bureau’s American Community Survey, the Bureau of Economic Analysis and the Federal Communications Commission, the report compiled information for all 382 metropolitan statistical areas (MSAs) and the economic contributions of the internet sector in them. We focus on the internet sector specifically rather than broader sectors such as ‘high tech’ because we argue that other ‘tech’ sectors are not well-defined and also because evidence has shown that productivity growth in ‘tech’ sector has fundamentally shifted away from hardware and advanced manufacturing components into the digital realm.8 More plainly, the internet and digital sectors are the economic drivers of the future. Another equally important reason for our selection of the internet sector versus some other ‘tech’ term is that the policy and technology initiatives being implemented in our case studies fundamentally rely on digital technology and the internet. In other words, it is the most appropriate economic component for providing context in the broader policy focus of this report.

3.2 The internet sector’s contributions to urban economies

Generally speaking, we see the same type and scale of positive contributions from the internet sector in urban economies as we do at larger aggregations; though, unsurprisingly, the sector’s contributions are typically higher in denser metropolitan areas than in states overall. Using MSAs as our units, the internet sector contributes approximately 3.3 percent of both employment and establishments on average in America’s urban areas. This equates to over 9,000 jobs and nearly 570 businesses per metro.910 The leading internet economies are as expected. The MSA with the largest overall number of internet employees and internet establishments is the New York City-Newark-Jersey City, NY-NJ-PA Metro Area, which is also by the largest MSA in terms of population. This metro area boasts nearly 300,000 (3.7 percent) internet sector employees and over 21,000 (3.5 percent) internet sector establishments. The MSA with the largest concentration of internet employees and businesses is Silicon Valley, the area of San Jose-Sunnyvale-Santa Clara, CA Metro Area. The internet sector contributes approximately 13 percent of employment and 9 percent of establishments in the MSA. Table 1 provides these and other summary figures by MSAs for the sector, including the report’s case studies, while Table 2 examines the ratios of total internet employment and establishments for key MSAs to the national averages to demonstrate the ‘concentration’ of the sector in MSAs. It also provides the ranks among all MSAs for each of the cities presented.

Table 1: The Internet Sector in Cities

| Metropolitan Area | Total Employment | Internet Sector Employment | Internet Sector Employment as a% Total | Total Establishments (businesses) | Internet Establishments | Internet Establishments as a % Total |

|---|---|---|---|---|---|---|

| Average Among MSAs | 274,300 | 9,000 | 3.3% | 17,100 | 600 | 3.3% |

| Aggregate for all MSAs | 104,509,400 | 3,440,700 | 3.3% | 6,500,900 | 214,100 | 3.3% |

| Silicon Valley | ||||||

| San Jose-Sunnyvale-Santa Clara, CA Metro Area* | 974,000 | 126,600 | 13.0% | 48,000 | 4,300 | 8.9% |

| Top 5 Largest Metro Areas (2014 population) | ||||||

| New York-Newark-Jersey City, NY-NJ-PA Metro Area | 8,040,200 | 295,000 | 3.7% | 569,100 | 20,100 | 3.5% |

| Los Angeles-Long Beach-Anaheim, CA Metro Area | 5,354,000 | 147,500 | 2.8% | 349,900 | 11,600 | 3.3% |

| Chicago-Naperville-Elgin, IL-IN-WI Metro Area | 4,079,200 | 124,000 | 3.0% | 241,300 | 9,200 | 3.8% |

| Dallas-Fort Worth-Arlington, TX Metro Area | 2,869,700 | 125,100 | 4.4% | 152,400 | 6,600 | 4.3% |

| Houston-The Woodlands-Sugar Land, TX Metro Area | 2,507,600 | 55,900 | 2.2% | 132,700 | 4,100 | 3.1% |

| Report Case Studies | ||||||

| Columbus, OH Metro Area | 826,900 | 25,400 | 3.1% | 40,900 | 1,500 | 3.6% |

| Kansas City, MO-KS Metro Area | 908,300 | 45,500 | 5.0% | 51,500 | 1,700 | 3.3% |

| Phoenix-Mesa-Scottsdale, AZ Metro Area | 1,574,000 | 46,400 | 2.9% | 90,900 | 2,900 | 3.2% |

| Pittsburgh, PA Metro Area | 1,092,700 | 26,400 | 2.4% | 59,600 | 1,600 | 2.6% |

Note: Table uses 2014 data; figures are estimates only and rounded to nearest 100 *These estimates are based on Internet Association’s sector identification methodology developed in “Measuring the US Internet Sector” by Stephen Siwek and Economists Incorporated. Given shortcomings in government industrial codes for capturing tech, these figures are almost certainly underestimates and particularly in the case of the Silicon Valley area where tech companies and internet companies may be classified into a ‘traditional’ sector given their product or service line instead of being captured in the (arguably) more appropriate internet component industries.

Table 2: Comparing Internet Sector Footprints Among MSAs

| Metropolitan Area | Ratio of Internet Sector Employment to National Average | Ratio of Internet Sector Establishments to National Average | Rank Among MSAs – Internet Establishments | Rank Among MSAs – Internet Employment | Rank Among MSAs – Population |

|---|---|---|---|---|---|

| Silicon Valley | |||||

| San Jose-Sunnyvale-Santa Clara, CA Metro Area* | 14.02 | 7.57 | 11 | 5 | 35 |

| Top 5 Largest Metro Areas (2014 population) | |||||

| New York-Newark-Jersey City, NY-NJ-PA Metro Area | 32.67 | 35.84 | 1 | 1 | 1 |

| Los Angeles-Long Beach-Anaheim, CA Metro Area | 16.34 | 20.60 | 3 | 3 | 2 |

| Chicago-Naperville-Elgin, IL-IN-WI Metro Area | 13.73 | 16.45 | 4 | 7 | 3 |

| Dallas-Fort Worth-Arlington, TX Metro Area | 13.85 | 11.76 | 7 | 6 | 4 |

| Houston-The Woodlands-Sugar Land, TX Metro Area | 6.19 | 7.27 | 13 | 14 | 5 |

| Report Case Studies | |||||

| Columbus, OH Metro Area | 2.81 | 2.63 | 31 | 31 | 33 |

| Kansas City, MO-KS Metro Area | 5.04 | 2.98 | 26 | 19 | 31 |

| Phoenix-Mesa-Scottsdale, AZ Metro Area | 5.13 | 5.23 | 18 | 17 | 13 |

| Pittsburgh, PA Metro Area | 2.92 | 2.76 | 29 | 28 | 23 |

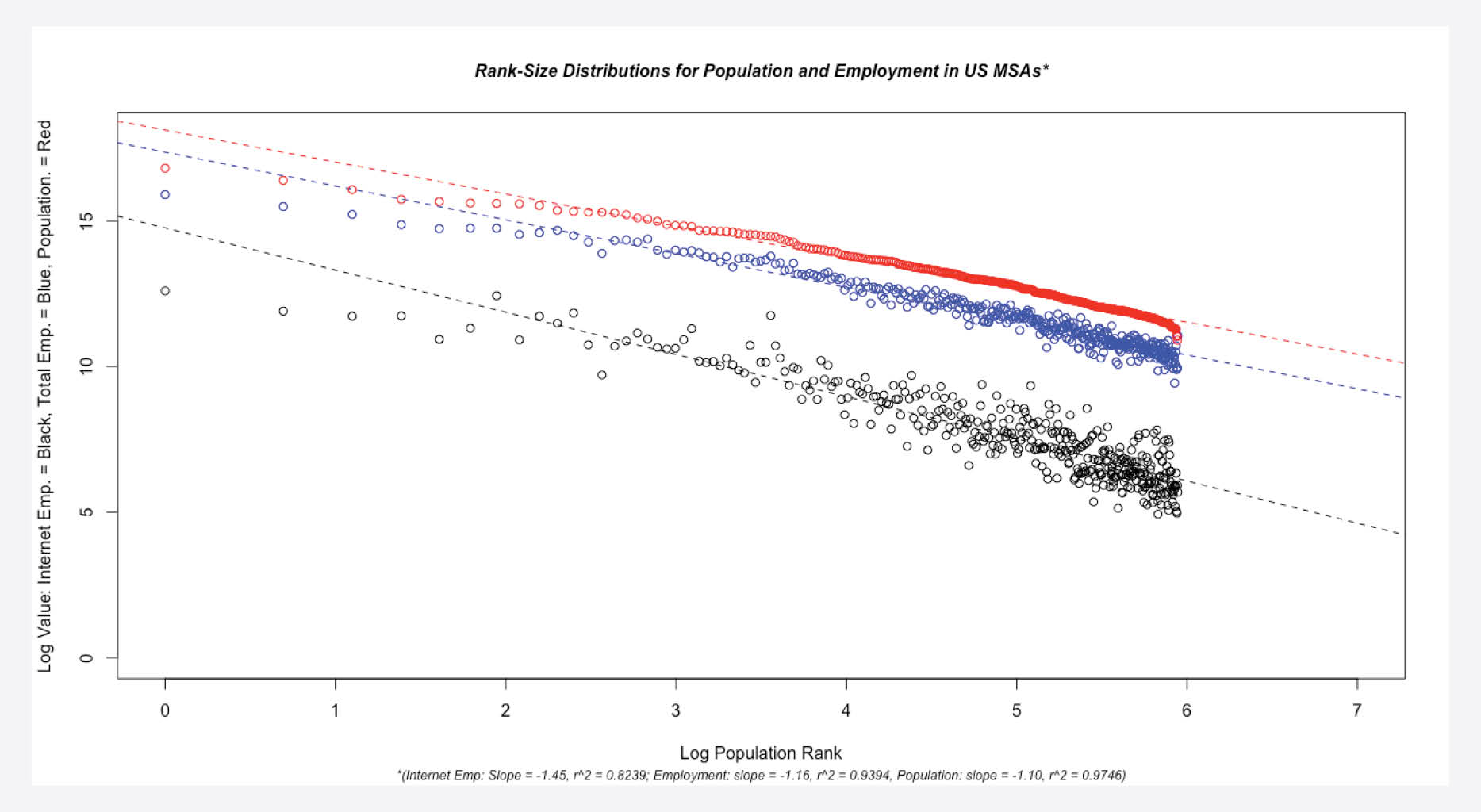

Note: Table uses 2014 data *See note in Table 1 From a broader perspective, the data also demonstrate that the internet sector contributes to vibrant urban economies. As shown in Figure 1 and Figure 2, there are strong positive correlations between the internet sector (both employment and establishments) within an urban area and that area’s median income level, GDP per capita, and total GDP. Additionally, there is a strong negative correlation between internet sector (both employment and establishments) and unemployment and a negative correlation, though weaker, with an urban area’s poverty rate. Across MSAs within the United States, metropolitan areas with strong internet sectors also have strong economies overall. And, contrary to the sentiment of some, the internet sector is not concentrated in or benefitting only the largest U.S. cities. In Figures 3 and 4, which conduct rank-size distribution analysis based on the Zipf’s Law, the report demonstrates that while internet sector employment is less evenly distributed among all MSAs compared to population and overall employment, internet employment is also far less tied to a city’s population than overall employment. This illustrates that the internet sector – and perhaps the tech sector more broadly – holds great potential for medium and small-size cities. Rather than quantity of residents, a robust digital economy is linked to the quality of the educational and policy mix within a city, suggesting some may be overlooking their potential for developing well-paid internet sector jobs. Figure 1: The Influence of Internet Sector Employment on Urban Economies  Figure 2: The Influence of Internet Sector Establishments on Urban Economies

Figure 2: The Influence of Internet Sector Establishments on Urban Economies  Figure 3

Figure 3  Figure 4

Figure 4

3.3 Recognizing new potential

This is not to suggest that the development of a strong digital economy is a cure-all for urban policymakers. However, there should be a recognition that the development through policy of reasonable internet business environmental conditions (as analyzed in Internet Association’s Ease of Doing Business study11) and an actualized digital sector both contribute to the overall economic welfare of places. Given the range of challenges faced by cities and other localities, the report argues that it is crucial to develop informed policy decisions that are shaped by data and facts and that are suitable for each context; that argument is one of the driving motivations of the case study approach used here. Beyond the measurable figures, there is also another element to the internet sector and digital economy that is widely unknown – the lack of a full picture. The full range of economic contributions of new technologies are simply not captured in data leaving us only a partial view of how urban economies are evolving. More specifically, the figures provided above (along with other estimates) are likely underestimating the overall economic contributions. This relates to the limitations of a standard input-output approach to measurement, which relies on formal industrial codes from official government agencies. This is an issue because (first) the internet is not formally incorporated into those codes and (second) the industrial equivalencies that we are able to draw miss large portions of the new economy. For example, we can capture the number of IT engineers and even custodial staff at a software company, but we cannot currently capture the number of individuals that earn extra income via sharing economy sites like Lyft, Uber, Airbnb, or others. Another component of this underestimation comes from indirect benefits that have economic impact, but for which we cannot yet capture in data. In one example, a report from Upwork and the Freelancers Union (Freelancing in America: 2016 Survey12) found that approximately two-thirds of freelance workers in the United States pursue freelance work because of personal preference (this is for all freelancers and not just technology-enabled freelancers). This report aside, motivating factors like time-saved or work schedule flexibility through online intermediaries are often poorly measured and understood.13 If we take the example of autonomous vehicles (already mentioned in reference to an OECD study14), the cost savings, increased investment into other urban programs, decreased sunk costs in time and other impacts from a dramatic decrease in vehicular traffic have not yet been measured. In another example, the provision of free Wi-Fi within a city may allow individuals to more easily find employment opportunities, but modeling that increased efficiency in labor market matching is not yet developed. Despite this underestimation, there is an intrinsic sense of cities returning to the forefront of innovation, specifically through the utilization of digital tools. Anecdotally, few could deny the publicity and cultural value of the Kansas City Public Library Twitter feud with the New York City Public Library during the 2015 World Series.15 Few can argue with the immense value of being able to follow Phoenix’s (and other cities’) city public works account to keep up to date on city developments.16 What’s missing is a better understanding of what this value is and how it can be enabled through policy.

Case Studies

4.1 Overview

Moving away from the general discussion on the digital economy in urban areas, it is important to highlight the rationale of this report’s case studies. The primary motivation for the selection of Columbus, Kansas City, Phoenix and Pittsburgh relates to policy and timing. Numerous articles and reports have examined the development of famous tech areas like Silicon Valley, Route 128, and elsewhere ex post, but few, if any, have examined policy formulation in the moment. Each of the case studies are in the beginning stages of a positive tech-driven urban revitalization17 and offer precisely that type of perspective. Examining the figures for the report’s case study in Tables 1 and 2, two things become immediately clear. First, each of the four cities enjoys higher than average internet sector presence (as measured by employment and establishments). Second, despite that concentrated presence, when we account for their populations, they are not necessarily ‘punching above their weight’ – Columbus and Kansas City both have internet sectors that are disproportionately high based on their populations while Phoenix and Pittsburgh do not. This speaks to the nature of the digital economy – while larger populations may be beneficial to the development of a 21st century economy, it is not inherently tied to innovation; small and medium-sized urban areas can and do have vibrant technology sectors. Nor should the volume of tech jobs and businesses be seen as the only proxy for an innovative city; similar to challenges measuring the internet sector’s presence in economic data, the strength of a city’s smart initiatives may not be immediately seen in data. Tracking the development over time, our case studies also present nuance. Growth since 2010 in internet sector employment in each of the case studies has outpaced the national average among all MSAs. However, growth in internet establishments over that period was lower in each of the case studies than the national average. These are shown in Figures 5 and 6 respectively. What do these divergent trends mean? The report interprets them as evidence that the digital economies of these cities are stabilizing. This is based off a few key points. First and as mentioned, each case study has a higher than average concentration of internet sector employees and establishments. Second, the cumulative growth rates for both metrics are positive for each of the case studies since 2010. Third, the average MSA growth in internet establishments has been rapid with about 5.5 percent average growth per year – far outpacing other national metrics such as average MSA GDP per capita growth, which was only 3 percent for the entire period between 2010-2014. Fourth, we interpret the difference between employment and establishment growth as being a sign of existing internet firms hiring new employees. Finally, we also argue this based on the analysis and discussion for each individual case study presented in the following subsections (presented in alphabetical order by city name).

4.2 Columbus

Columbus is the capital city of Ohio and the second largest city in the Midwest. Although it’s prominently known as the main campus locale for The Ohio State University, the city is much more than a college town. It boasts a population of just over 860,000 people, a diverse economy and the headquarters of five Fortune 500 corporations, including Nationwide Mutual Insurance Company, American Electric Power, L Brands, Big Lots and Cardinal Health.18 Because of the economic diversification, Columbus was able to weather the nation’s 2007 recession better than many other Midwestern cities.

Table 3

| Columbus, OH Metro Area | |

|---|---|

| Total Employment | 826,900 |

| Internet Sector Employment | 25,400 |

| Internet Sector Employment as a % Total | 3.1% |

| Total Establishments (businesses) | 40,900 |

| Internet Establishments | 1,500 |

| Internet Establishments as a % Total | 3.6% |

| Ratio of Internet Sector Employment to National Average | 2.81 |

| Ratio of Internet Sector Establishments to National Average | 2.63 |

| Rank Among MSAs – Internet Establishments | 31 |

| Rank Among MSAs – Internet Employment | 31 |

| Rank Among MSAs – Population | 33 |

The Right Stuff In 2016 Columbus became known, almost overnight, as an innovation hub when it won the Smart City Challenge19; however, it is also commonly lauded for its general economic strength and future prospects. In 2007, the city was ranked third in the United States by fDi Magazine for “Cities of the Future,” and fourth for most business-friendly in the country. In 2008, it ranked as the seventh best place in the country to operate a business.20 The strength and optimism of Columbus can be largely attributed to its admirable mix of environmental factors. The city has long since diversified its economy, implemented a thoughtful business approach and capitalized on its local institutions to build a well-trained workforce. Serving as the state capitol of Ohio and as the home of a major flagship university, it enjoys a robust local economy, but has not rested on its laurels – the city ranks highly in terms of educational attainment for U.S. metro areas and is quickly gaining a reputation for culture, amenities, and tech. These characteristics provide an anecdote to research demonstrating the value of developing local environments – in particular, internet environments for a strong tech sector.21 Cities and other local areas must make sustained, concerted efforts to develop the right foundation for the 21st century through workforce development, financing opportunities, general business governance, and high-quality internet access. While not guarantors of economic success, these are essential elements for that success as well as for the success of new policy initiatives and programs. Smart City, Smart Transit A clear example of the value of foundational efforts can be seen in “Smart Columbus” win in the U.S. Department of Transportation (USDOT) Smart City Challenge. The challenge asked cities to develop ideas for an integrated, first-of-its-kind smart transportation system that would use data, applications and technology to help people and goods move more quickly, cheaply, and efficiently. Columbus’ proposal included a variety of innovative projects such as an integrated data exchange to better serve local residents and a connected vehicles program where members of the public are encouraged to sign up.22 Kansas City has moved beyond its slightly less legal traditions to become a tech hub in the Midwest. It is the largest city in Missouri, with a population of 481,420 people and centers the Kansas City metropolitan area of over 2 million people straddling the Kansas-Missouri state near the confluence of the Kansas and Missouri rivers. The jazz clubs, mob ties, and voluminous food scene remain, but today the economy is more diversified with many notable companies headquartered in the area (including Sprint Nextel, H&R Block and others) and a sizeable Federal Government presence (including one of 10 regional offices for the U.S. government, 146 agency offices and one of the 12 regional Federal Reserve Banks).23

Table 4

| Kansas City, MO-KS Metro Area | |

|---|---|

| Total Employment | 908,300 |

| Internet Sector Employment | 45,500 |

| Internet Sector Employment as a % Total | 5.0% |

| Total Establishments (businesses) | 51,500 |

| Internet Establishments | 1,700 |

| Internet Establishments as a % Total | 3.3% |

| Ratio of Internet Sector Employment to National Average | 5.04 |

| Ratio of Internet Sector Establishments to National Average | 2.98 |

| Rank Among MSAs – Internet Establishments | 26 |

| Rank Among MSAs – Internet Employment | 19 |

| Rank Among MSAs – Population | 31 |

Tech and Culture Kansas City has embraced technology and innovation in a significant way, but also in a manner that leverages its local strengths and characteristics (see Window 2). The city and the region surrounding it have gone to great lengths to promote STEM fields and bring new technology companies through coordinated efforts. Currently approximately 94,000 area workers are employed in tech-related jobs24 with about half of those working in the internet sector. The city has been one of the fastest growing tech scenes of the past decade according to Forbes magazine. And the tech companies, such as Garmin, that have set up shop there and several other companies from the San Francisco Bay area are flocking to the burgeoning tech community, in part due to economic incentives offered by the city and the state of Missouri.25 26 This development builds off the success of its long established non-tech innovative industries like architecture, animal health/veterinary sciences and creative fields.27 It also reflects the appeal of the city’s low cost of living, a 20-year regeneration/development and major ‘gets’ such as being the flagship city for Google Fiber.28 Research has shown a strong correlation between high cost of living and internet sector presence, but as more cities, including Kansas City, continue to develop their tech sectors while remaining equitable in their growth, their appeal is growing. Economic Inclusion The city has also embraced technology with an eye toward inclusive development. Its plan is not simply to develop through technology, but to push education and accessibility in conjunction with technology as part of the larger policy goal of improving economic opportunities for all residents of the metropolitan area. In 2016, the city moved toward achieving status as a smart city,29 when it announced a $15 million-dollar partnership project with Cisco to outfit the city’s two-mile streetcar corridor with smart city technology.30 Perhaps more importantly, the free streetcar service serves as a model for improved public transportation in the booming downtown neighborhoods of the city, providing more residents access to opportunities across the city’s primary commercial areas. The city is also making a strong push to continually improve access to high-speed internet and recently adopted its first digital inclusion plan, called the Digital Equity Strategic Plan.31 This plan formalizes the metro area’s strategy “from digital inclusion to economic mobility and entrepreneurship.”

Window 3: A Different Kind of Incubator

There can be more to tech than just tech. Often overlooked is the application of innovative practices and tools made famous in the internet and tech sectors in other areas. In Kansas City, stakeholders are applying the time-tested idea of incubators to tech, but also a variety of other industries. Downtown in the city’s Crossroads district, you can find the Arts Incubator, which capitalizes on the city’s long arts tradition offering an innovative program for the city’s many aspiring artists and art school graduates to hone their artistic and business skills.32 The community offers personal work and studio space, common spaces, events, and programs to help artists develop all while artists take full advantage of digital platforms to sell works, publicize exhibitions, and more. Just up the road in Midtown, the more recent Makers Village taps into the city’s industrial and craftsman traditions. The space aims to foster entrepreneurs focused on high-skilled trades (in the most traditional sense of the word).33 By applying the same ‘tech’ principles of collaboration, ongoing education, and removal of barriers in other areas, Kansas City is fostering innovation across its sectors.

4.4 Phoenix

Phoenix is the capitol of and most populous city in the state of Arizona, and the fifth largest city in the United States. It was established in 1868, named after the mythical bird in recognition of the challenges of building a city out of the harshness of the southwest desert. Phoenix experienced significant growth after World War II, when many of the men who had trained in or around Arizona settled their families in the area. This resulted in an industrial boon. Motorola established a military electronic research and development center and several other technology companies soon followed. The city’s economy was significantly driven by the technology and electronics sectors through the 1960s. Today, the city’s economy is much more diversified and it hosts the headquarters of five Fortune 500 companies, along with another 11 Fortune 1000 companies, but tech remains a principle component of the economy – over the ten year period of 2006-2016, the metro area increased its number of tech workers by nearly 50 percent.

Table 5

| Phoenix-Mesa-Scottsdale, AZ Metro Area | |

|---|---|

| Total Employment | 1,574,000 |

| Internet Sector Employment | 46,400 |

| Internet Sector Employment as a % Total | 2.9% |

| Total Establishments (businesses) | 90,900 |

| Internet Establishments | 2,900 |

| Internet Establishments as a % Total | 3.2% |

| Ratio of Internet Sector Employment to National Average | 5.13 |

| Ratio of Internet Sector Establishments to National Average | 5.23 |

| Rank Among MSAs – Internet Establishments | 18 |

| Rank Among MSAs – Internet Employment | 17 |

| Rank Among MSAs – Population | 13 |

Development Through Experimentation The state of Arizona’s emphasis on innovation has kept technology and innovation front and center. And in the Phoenix metro area, there has been a particular focus on allowing innovation to happen with the city making a particular point to link the economic prospects of the Phoenix area to the new technologies of the future.34 In one example, Uber recently announced a self-driving car pilot in Tempe (the home of Arizona State University’s flagship campus and part of the Phoenix metro area). Uber chose these locations for testing of autonomous vehicles in part because the state was open and welcoming to new technologies. Arizona’s Governor, Doug Ducey, led the way in allowing the program, declaring, “In 2015, I signed an executive order supporting the testing and operation of self-driving cars in Arizona with an emphasis on innovation, economic growth, and, most importantly, public safety. This is about economic development, but it’s also about changing the way we live and work.”35 In another example, in 2014, the city of Phoenix adopted an open government data policy to increase transparency and make valuable data available to the public – including app developers. Since then, the city has made hundreds of data sets available and promoted the initiative through hackathons and partnerships with startups and co-working spaces. And in 2017, the city contracted with Open Gov to launch a new open data portal to make it even easier to access information through improved file systems and data visualization. Diversification Through Innovation Underlying the metro area’s openness to innovation and experimentation is the broader goal of diversification. Since taking office, Mayor Greg Stanton has worked to diversify Phoenix’s economy – from one overly reliant on real estate to one rooted in innovation and the incorporation of useful digital technologies in other ‘traditional’ sectors. This includes a concerted economic development strategy focused on building a talent base and recruiting technology companies to set up shop in the city, as well as an effort to support growing startups that already call Phoenix home. By directly building campuses for biosciences and higher education, supporting startups, and aggressively pursuing innovation-focused companies looking to grow or expand, the number of tech companies located in downtown Phoenix has quadrupled over the past five years from 67 to more than 275. Meanwhile, that same spirit of innovation has driven an impressive set of partnerships with private sector stakeholders to help local ‘non-tech’ workers gain the skills they need to also participate in the city’s new economic sectors (see Window 4).

Window 4: Leveraging Technology Through Partnerships

In Phoenix, local and state leaders partnered with LinkedIn and Skillful to learn more about the needs of middle skill workers in the area. Through Skillful, a partnership initiative of the Markle Foundation, LinkedIn, Arizona State University, the City of Phoenix, and Maricopa County, local stakeholders worked to strengthen the area’s labor market through improved diagnostics of skills, matching, and training. The LinkedIn team worked with the local stakeholders to provide data that improved transparency into the skills job seekers have, the skills they need, where they can find training, and how they can build a sustainable career. They then applied those learnings to LinkedIn products and shared findings with policy leaders to better inform their decision-making on workforce and education issues. The goal of this initiative is to narrow the middle skills gaps in Phoenix with a focus on three areas: 1) Research & Learn: Better understanding the needs, pathways, and barriers for middle-skilled workers 2) Analytics & Data: Showcasing data and insights to key stakeholders (policy and community leaders) to help support middle-skilled workers; providing specific recommendations or lessons on opportunities for the middle-skill worker 3) Civic Engagement: Developing signature pilot projects and partnerships to serve communities The initiative has resulted in numerous projects and campaigns designed to leverage technology to improve the lives of residents of the Phoenix area. Some highlights include: Next-Generation Coaching: Better Counsel via Data and Tools In 2016, initiative partners trained more than 6,000 workers, career coaches, and navigators. In collaboration with Skillful and their navigator corp, partners provided train-the-trainer sessions for workforce center staff throughout Maricopa County to improve training and better understand skills-based hiring. Strengthen Educator-Employer Partnerships In 2016, LinkedIn launched Training Finder in Phoenix (as well as Colorado). This tool is designed to make it simple for job and training seekers to find the best short-term training in their region. Members can search programs by industry, skill, potential job title, or training provider as well as information on starting salaries, affiliated employers, and alumni for each certificate or program. The goal of these partnerships and projects is to create economic opportunity. For the local stakeholders in Phoenix it is an opportunity to improve efficiency, services, and the lives of the area’s residents. For its partners, it is a valuable way to learn about the actual make-up of labor markets (including the market beyond white-collar professionals) and to work with the community directly as a testbed for new products and other

4.5 Pittsburgh

First settled in 1764 at the confluence of the Monongahela and Allegheny rivers, the city of Pittsburgh at one point could boast to be the maker of between one-third and one-half of all U.S. steel output. All of those steel mills brought with them good-paying blue-collar jobs, as well as enough pollution to brand the city with one of its many monikers, soot city. In 1910, Pittsburgh was the nation’s 8th largest city and behind only New York and Chicago in corporate headquarters employment. In 1950, Pittsburgh had 680,000, but beginning in the 1970s, as deindustrialization began to impact many U.S. industries, the city began to shed workers. Between 1970 and 2000, the city lost 40 percent of its population and by 1983, unemployment hit 17.1 percent as the city shed 4,000 residents a month. As the mills closed, opportunity seemed to close with them, but Pittsburgh chose to fight its decline by embracing a realizable future.

Table 6

| Pittsburgh, PA Metro Area | |

|---|---|

| Total Employment | 1,092,700 |

| Internet Sector Employment | 26,400 |

| Internet Sector Employment as a % Total | 2.4% |

| Total Establishments (businesses) | 59,600 |

| Internet Establishments | 1,600 |

| Internet Establishments as a % Total | 2.6% |

| Ratio of Internet Sector Employment to National Average | 2.92 |

| Ratio of Internet Sector Establishments to National Average | 2.76 |

| Rank Among MSAs – Internet Establishments | 29 |

| Rank Among MSAs – Internet Employment | 28 |

| Rank Among MSAs – Population | 23 |

Innovating Through Partnerships Today, Pittsburgh’s population sits at approximately 305,000 while the larger metro area that it anchors counts over 2.3 million residents. And while challenges remain, the city has emerged from its roller-coaster history as a leading technology city. Along with Kansas City and Columbus, Pittsburgh was one of seven national finalists in the USDOT Smart City Challenge and the city has earned a reputation as a leading center of technology education. Indeed, the city hosts several world-renowned universities including University of Pittsburgh (chartered in 1787), Chatham University (founded in 1869) and Carnegie Mellon University (endowed in 1900). City leaders have embraced the integration of technology into policy and development, working to build and maintain balanced relationships with tech stakeholders as evidenced by the presence of offices for Google, General Motors, Uber, and numerous other leading tech firms as well as dozens more start-ups. But beyond just having a ‘footprint’, the city is also committed to improving its own capabilities and strong inclusiveness in its ‘tech’ programs as evidenced by its work with the Urban Redevelopment Authority of Pittsburgh to support the Roadmap for Inclusive Innovation. A leading example of the city’s efforts to support innovation is the PGH Lab program. The PGH Lab program provides opportunities for local start-ups to work with the city of Pittsburgh and municipal authorities to get real-world implementation experience with their products through partnerships with client organizations. It is viewed by the city as a unique pipeline program that allows the city to both foster start-ups while simultaneously capitalizing on the new innovative products and services offered by those start-ups to improve city governance. As described by Lee Haller, the Director of the Pittsburgh Department of Innovation & Performance, “The PGH Lab program is a unique opportunity for the city of Pittsburgh and our partners to benefit from cutting-edge technologies and solutions while at the same time supporting local start-up companies and the innovation economy that is so important to the future of the Pittsburgh region.” Procuring the Future One of the primary challenges Pittsburgh faces when crafting internet economy policies is around procurement. Procurement regulations are not always conducive to sourcing cutting-edge technologies and solutions that require the city to test them out prior to a larger-scale implementation. As an example, Pittsburgh’s Public Works Department wanted to implement garbage can sensors on public space trash cans to improve the efficiency of the daily collection work done across the city. However, to demonstrate that this new technology could allow the department to provide better service for this particular function, the city needed to conduct a pilot of the technology that was at a scale large enough to have an operational impact. Luckily, the city found a vendor in the space that was willing to work on the pilot within the bounds of its current procurement rules, allowing the city to develop an innovative approach to services. Based on these experiences, city officials continue to find it important to explore ways of setting up procurement procedures that provide structure for testing new ideas. The use of rapid pilot programs for new technologies is one approach that can lead into longer-term contracts and provide stabilization in implementation.

Lessons for Policymakers and Stakeholders

This report identifies a few primary policy considerations and themes based on its research.

5.1 Building the Foundation

This first may be obvious, but it is worth emphasizing: a city’s environmental factors are key. Specifically, infrastructure investment, educational investments and the removal of access barriers are essential policy elements for developing a successful economy in the 21st century. Past research demonstrates that these elements outweigh other considerations for internet sector firm locational decisions.36 In particular, workforces with the right STEM skills/training and localities with better internet accessibility (i.e. internet infrastructure and access points) show stronger correlations with the location of internet firms than other factors like financing, costs, and incentives. This suggests that one-off efforts, such as an incubator, will not be impactful absent these foundational environmental components. Put differently, a more specific ‘tech’ policy should not be considered or implemented in a vacuum that fails to consider and address foundational characteristics of a city. This arguably holds true for any urban governance issue, but it is particularly true with the internet sector and digital economy. Efforts to attract tech firms that do not simultaneously build a local labor market with skills in coding, engineering, mathematics, and other crucial areas will not yield positive development. Conversely, initiatives to retrain workers and educate young populations will fall short if other efforts to remove barriers to start-ups and larger firms are not also pursued. Cities that put up too many barriers to innovation will see start-ups move away. Infrastructure, education, and barrier removal are the foundation for the development of a strong internet sector and digital economy. They are long-term, often requiring years, if not decades, of sustained policy attention and they will likely not offer many immediate returns. However, the experiences of successful ‘tech’ hubs and evidence in the data point to their necessity.

5.2 General tools for the new economy

Beyond generalities, our case study cities point to the usefulness of pursuing tech development initiatives through partnerships and in a manner that incorporates the historical and cultural characteristics of an area. Representatives of the report’s case study cities – as well as private sector companies that the authors met with – all pointed to partnership programs between government and other stakeholders as successful models across different initiative types. Within these observations is the intrinsic recognition that governments likely cannot innovate at the same speed as the internet sector while firms may be unable to scale without the initial testing opportunities that can be offered by government. The use of pilot programs for technology testing, data sharing, diagnostic work for initiative targeting, and other mutually beneficial relationships improve the development of both individual companies and the cities in which they reside. Furthermore, the explicit recognition of that city (locality) in broader strategy improves the likelihood of success for all stakeholders. We can see this in the strategy of Phoenix to pursue a strong use of data and analytics to improve its worker re-training programs and broader economic diversification efforts – the city clearly recognized the lack of industrial diversity and the over-prevalence of only a few industries and chose the longer, but more sustainable road of developing a strategy utilizing technology to directly address the issue rather than doubling down on incumbent sectors. We can also see this in Pittsburgh where the city has cleverly focused on areas complementary to its industrial history and innovation like robotics and automation rather than trying to turn the city into something unrelated like a financial hub. This is perhaps best seen in its partnership with Carnegie Mellon University and Uber to test autonomous vehicles, but more generally Pittsburgh has wisely chosen to leverage its long-standing educational track record in these fields and has leaned on the expertise of its major institutions (such as Carnegie Mellon).

5.3 Development for all

Another key policy consideration is stimulating development in an inclusive manner. This is both a goal and a challenge for city leaders. The internet sector is inherently (currently) tied to high levels of education and high-quality internet access and equipment. Put in a different light, it exhibits characteristics that mirror long-standing urban issues like spatial and socioeconomic inequality. Policymakers and the internet industry are highly sensitive of this and have a joint interest in ensuring the right policies are pursued. Furthermore, research also shows that the internet has facilitated tens of millions of additional income opportunities to individuals through platforms, freelancing, supply and demand matching, and other services – ones that are not tied to educational levels and which appear to serve, among other things, as a key crucial income supplements.37 Private sector firms recognize this issue and are pursuing numerous efforts to diversify their own workforces and foster the tech sectors of places outside of headquarter cities; however, local governments can also play a key role in more evenly distributing the opportunities offered by a strong digital economy. Access is key and efforts to improve access of individuals through public transportation, online access points, broadband infrastructure, lower business costs, and more can all assist in catalyzing local internet businesses while also allowing broader sections of a city’s population access to the jobs they create. Arguably the most beautiful element of the internet sector and digital economy is the virtual lack of barriers for individuals and entrepreneurs (including micro-entrepreneurs). An engineer can win contracts on program design simply with her computer; an artist can begin selling his work internationally through a few clicks on a mouse at the public library; a mother can re-enter the workforce through an efficient and targeted job search online; a business owner can promote his launch event through social media. These are anecdotes and illustrations, but they are true millions of times over in individual stories. And cities that can build on these technologies in new and innovative ways through more-targeted, low-cost initiatives will have more success in achieving economic development for all their citizens.

5.4 Integration of private tools into public services

Finally, the report’s research points to the importance of integrating technology into public services. A simple client-provider relationship between cities and digital firms cannot be adopted; rather, cities should proactively work to identify areas where new digital tools can improve existing public services in addition to their broader sector development efforts. Pilot programs are a popular way for cities to new technology applications and open data programs are useful way for drawing in outside researchers and partners for help on issues ranging from policing strategies to freight truck route optimization and more. The goal should be to address specific challenges through specific technologies or applications. The results, if successful, should be self-sustaining so that the challenge is resolved indefinitely.

Conclusion

Examples of city leadership throughout the country demonstrate how cities are shaping the story of America. However, as challenges to cities continue to proliferate at different levels, cities need to band together to move the country forward. No city is its own island—all are interconnected— and the nation only succeeds when cities succeed. The early glimpses we have seen of the 21st century economy are exciting, but they also reveal clear challenges. Now, and in the coming years, technological development and the innovation of the internet sector will bring forth countless new inventions and opportunities. They will also bring great disruption. There is no government entity better equipped to handle those disruptions and fully capitalize on the amazing developments that the internet and digital economies can offer than cities. Local governments are the nimblest entities and most directly connected to their constituents. If cities and their leaders exercise prudence through study, experimentation, and analysis now, they will be well-equipped to integrate new technologies and sectors into their urban landscapes tomorrow. In the new economy, the critical leadership of mayors and other local leaders will push the country forward for the better.

- The report repeatedly uses the terms “internet sector” and “digital economy”. The former refers to the industrial sector composed of internet and digital technology companies as formally defined by Internet Association. The latter refers to the larger economy that has developed from the internet, software, and cloud systems.↩

- Definitions of smart cities vary, but generally emphasize the integration of technology into the urban landscape and systems along with corresponding investments in human and social capital.↩

- https://www.itf-oecd.org/sites/default/files/docs/15cpb_self-drivingcars.pdf↩

- http://chicago.suntimes.com/news/mcdonalds-announces-move-to-downtown-chicago/↩

- https://internetassociation.org/wp-content/uploads/2015/12/Internet-Association-Measuring-the-US-Internet-Sector-12-10-15.pdf↩

- https://internetassociation.org/reports/refreshing-understanding-internet-economy-ia-report/↩

- https://internetassociation.org/reports/refreshing-understanding-internet-economy-ia-report/↩

- See Jorgenson’s ““Information Technology and the U.S. Economy” (2001) and Hooton and Kaing’s “Exploring machine learning’s contributions to economic productivity and innovation” (2017).↩

- Unfortunately, sufficient data are not available to allow for GDP estimates by MSA.↩

- Given the averages are only slightly higher than those for states and the national average, the data suggest that the internet sector also contributes a significant portion to the employment and businesses outside of major metropolitan areas.↩

- https://internetassociation.org/reports/ease-of-doing-internet-business/↩

- https://www.upwork.com/i/freelancing-in-america/2016/↩

- https://www.upwork.com/i/freelancing-in-america/2016/↩

- http://oecdinsights.org/2015/05/13/the-sharing-economy-how-shared-self-driving-cars-could-change-city-traffic/↩

- http://www.washingtontimes.com/news/2015/oct/30/kc-librarys-baseball-tweets-attract-international-/↩

- @TalkingTrashPHX↩

- Please note we use this term specifically in reference to the digital policy and economy initiatives and not in the broader sense of overall economic regeneration.↩

- “Fortune 500 features five Central Ohio companies, down from 6 last year”, Columbus Business First. 2013. Retrieved June 25, 2013.↩

- In December of 2015, the U.S. Department of Transportation launched its Smart City Challenge, asking mid-sized cities across America to develop ideas for an integrated, first-of-its-kind smart transportation system that would utilize data, applications, and technology to help people and goods move more quickly, cheaply, and efficiently. The Challenge generated 78 applications. From these, seven finalists were selected (Austin, Columbus, Denver, Kansas City, Pittsburgh, Portland, and San Francisco). Ultimately, the winner of the grant competition was Columbus.↩

- Market Watch, Best Places to do business Retrieved July 26, 2009.↩

- <a href="https://internetassociation.org/reports/ease-of-doing-internet-business/">https://internetassociation.org/reports/ease-of-doing-internet-business/</a>↩

- <a href="https://internetassociation.org/reports/ease-of-doing-internet-business/">https://internetassociation.org/reports/ease-of-doing-internet-business/</a> Competing with 77 other cities from across the country and driven by the desire to improve the city’s future through the reinvention of mobility, Columbus submitted its vision for the future to the USDOT’s unprecedented grant competition. The city’s winning proposal earned it $40 million plus a $10 million private sector match. However, the impetus to bring Columbus into the future revolves around more than just transportation systems. The city is indeed embracing autonomous vehicles (see Window 2) and other new transportation technologies, but the underlying goals of the city are much broader. The overall aims include: 1) improving quality of life in the region; 2) driving economic growth; 3) providing better access to jobs and more opportunity; 4) becoming a world class logistics leader; and, 5) fostering sustainability. According to city leaders, all of these goals will be sought after in the context of tying the city’s future to innovation in mobility. Yet, it takes little imagination to see how that innovation can be built upon.

Window 2: Connected Electric Autonomous Vehicles

That’s a mouthful, so we’ll just call them EAVs. EAVs can make getting around safer. In Columbus, six EAVs (on set routes) will connect riders in Easton – a popular retail and commercial hub in northeast Columbus – to first and last mile stops. They will help reduce congestion and traffic accidents by lowering opportunities for human error, thus making the city’s streets safer and more enjoyable. But beyond reducing the need to drive in a dense city, EAVs also offer environmental benefits by reducing pollution and emissions in the city. Indeed, Columbus (and its proposal with EAVs) was awarded an additional $10 million grant from Paul G. Allen’s Vulcan Inc. to reduce greenhouse gas emissions through the de-carbonization of the electric supply and transport sectors. The city has also been able to leverage USDOT/Vulcan investments with more than $360 million in pledges from public and private sector partners – a major investment by any standard.4.3 Kansas City (MO & KS)

While not completely removed from its “unwholesome” past of speakeasies, mobsters and juke joints,[footnote]<a href="http://www.npr.org/templates/transcript/transcript.php?storyId=14512796" rel="nofollow">http://www.npr.org/templates/transcript/transcript.php?storyId=14512796</a>↩

- The Federal Workforce by the Numbers – Kansas City. Greater Kansas City Federal Executive Board. 2011.↩

- <a href="http://www.kansascity.com/news/business/technology/article148948664.html" rel="nofollow">http://www.kansascity.com/news/business/technology/article148948664.html</a>↩

- <a href="http://www.govtech.com/dc/articles/Why-Are-So-Many-Tech-Companies-Moving-to-Kansas-City-Mo.html" rel="nofollow">http://www.govtech.com/dc/articles/Why-Are-So-Many-Tech-Companies-Moving-to-Kansas-City-Mo.html</a>↩

- <a href="https://www.bizjournals.com/kansascity/news/2017/02/10/california-tech-firm-moving-hq-creating-300-jobs.html" rel="nofollow">https://www.bizjournals.com/kansascity/news/2017/02/10/california-tech-firm-moving-hq-creating-300-jobs.html</a>↩

- <a href="http://www.economist.com/node/10218024" rel="nofollow">http://www.economist.com/node/10218024</a>↩

- <a href="https://www.nytimes.com/2014/08/20/realestate/commercial/millennials-going-to-kansas-city-to-live-and-work.html" rel="nofollow">https://www.nytimes.com/2014/08/20/realestate/commercial/millennials-going-to-kansas-city-to-live-and-work.html</a>↩

- It was also one of the seven finalists for the USDOT Smart City Challenge.↩

- https://techcrunch.com/2017/02/07/kansas-city-is-now-a-smart-city/↩

- <a href="http://kcmo.gov/citymanagersoffice/digital-equity-strategic-plan/" rel="nofollow">http://kcmo.gov/citymanagersoffice/digital-equity-strategic-plan/</a>↩

- <a href="http://curious.stratford.edu/2014/10/08/kansas-city-updates-tech-in-bid-to-boost-business/" rel="nofollow">http://curious.stratford.edu/2014/10/08/kansas-city-updates-tech-in-bid-to-boost-business/</a>↩

- <a href="http://kcur.org/post/maker-village-kc-hopes-prompt-innovation-through-old-fashioned-workspace#stream/0" rel="nofollow">http://kcur.org/post/maker-village-kc-hopes-prompt-innovation-through-old-fashioned-workspace#stream/0</a>↩

- <a href="http://www.govtech.com/events/Arizona-Digital-Government-Summit.html" rel="nofollow">http://www.govtech.com/events/Arizona-Digital-Government-Summit.html</a>↩

- <a href="https://www.phoenix.gov/econdev" rel="nofollow">https://www.phoenix.gov/econdev</a>↩

- <a href="https://internetassociation.org/reports/ease-of-doing-internet-business/">https://internetassociation.org/reports/ease-of-doing-internet-business/</a>↩

- See Hooton (2017). “America’s Online ‘Jobs’: Conceptualizations, Measurements, and Influencing Factors.” Business Economics (forthcoming).↩