Preface

Dear internet users,

How big is the internet? It seems like a basic question, but there is no simple answer because the internet is not a single monolith. Unlike the auto industry, which can be measured in terms of cars produced or manufacturing plants built, the internet’s massive economic contribution spans nearly every industry, and it is even creating entirely new industries. In the U.S. economy alone, it comprised approximately 6% of GDP in 2014 and has continued to grow rapidly, driving innovation at a faster rate than we have ever seen in human history.

More than 3.2 billion people use the internet, yet, if you ask most of us to tell you what “the internet” is, we may lack the right words to describe it. We understand how to use internet-enabled tools for everything from managing personal finances, to diagnosing illnesses, to ordering food from our favorite restaurants. Yet, we still struggle to accurately quantify the full impact of ubiquitous internet technology on our lives. For most, a full conceptual appreciation of the internet is neither necessary nor important; but, for policymakers, regulators, and other active stakeholders, we need to begin moving past outdated ideas and perceptions about the internet as a monolithic economic entity and recognize its nuances and complexities.

Too often policies and regulations for the internet are designed and implemented without any real appreciation for their short- or long-term impact. Often, this arises from a misunderstanding of the sector as a whole or from a misunderstanding of the particular platform or service model being targeted. The internet is not measured officially through industrial classification codes and the unofficial methods that have been developed by researchers are almost certainly too conservative. The classification codes that do exist poorly capture the full range of internet goods and services.

The negative consequences of these outdated methods for classification and assessment are not just academic. Businesses that didn’t exist just two or three years ago are being treated the same as industries created over a century ago. Regulations designed in the Great Depression are being applied to inventions that – even ten years ago – were outside the imaginations of even the greatest science fiction writers.

The lag between policy design and the innovation of the internet and its businesses is understandable given the sheer speed with which the internet has moved, but it is time to catch up. Designing internet regulations without properly understanding the sector can seriously undermine the success of its businesses and users for years to come. The Internet Association presents this white paper as a first step in refreshing the dialogue between the industry, policymakers, and other stakeholders to help avert poorly-informed policy decisions. It offers the first attempt to compile economic contribution estimates for the internet, calculates the first estimate of the economic contribution of mobile internet and app services to the economy, and lays out a better approach to conceptualizing the internet within our economic taxonomy. The goal is not to solve these issues in their entirety, but rather start the conversation and reinvigorate it with nuance, analysis, and consideration.

Sincerely,  Christopher Hooton, Ph.D. Chief Economist, The Internet Association

Christopher Hooton, Ph.D. Chief Economist, The Internet Association

Introduction

What was your first memory of the internet? A howling dial-up? Chat room sessions with your friends? Sending an email on your phone? Setting up a social media account? No matter your age or familiarity level, chances are the image is outdated.

The internet has long since evolved into a rich and diverse ecosystem of new platforms, businesses, and resources that have fundamentally changed the way in which markets function. In many ways, it has been the great economic equalizer, enabling low-cost entry and exit to firms, instant information to actors, transformation of consumer expectations, and the creation of a geographically neutral market where actors from different ends of the globe can connect and effectively interact regardless of borders. It is opening up new competition and pushing forward the frontier of production as it disrupts entrenched industries, sometimes provoking well-intentioned, but ill-advised reactions. It is fast – essentially instantaneous. It is open. And its evolution has and continues to outpace our attempts to grapple with it in research and policy.

The importance of the internet’s role in the global economy and national markets is under-researched and underappreciated. However, beyond matters of attention and scale, the manner in which we conceptualize and approach the internet must also change. It is no longer sufficient from an economic and policy standpoint to lump together the whole of the “Internet” into one amorphous thing. It requires more nuance in how we understand its economic contributions and more depth in the analysis that tries to quantify and make sense of it.

To that end this white paper calls for a modernized appreciation of what the internet does for our economy and presents a summation of recent literature to illustrate how and why such an exercise is needed. The paper begins in Section B by recapping studies examining the economic contributions of the internet, which as of 2014 stood at approximately 6% of GDP in the United States with every indication of continued growth (Siwek, 2015), and trying to more explicitly connect the internet to appreciable comparators. The section serves as a reminder of the economic importance of the internet and its activities and as a thought exercise for better ways to consider it going forward. Next, in Section C the paper extends these themes to the unofficial subsector of mobile internet and apps with the goal of demonstrating the logic and importance of improved economic classification. The paper applies the results and model of Christensen et al. (2015), which modeled the per unit GDP per capita contributions of smartphones and tablets (as a comparable for the examination of potential future impacts from Augmented Reality and Virtual Reality units) to figures found on usage from Pew and the National Research Council. From this it calculates a 3.11% GDP contribution from mobile internet and app services in the United States for 2015. The finding reinforces previous estimates of total GDP contributions from the internet sector as a whole and demonstrates the overdue importance of examining the internet in more detail. Building off Sections B and C, Section D proposes two alternative approaches to future economic conceptualizations of the internet through the use of industrial classification systems as a commencement to the dialogue in how to improve our conceptualization of the sector. Finally, Section E concludes.

The goal of the paper is not to resolve all issues related to the discussion of the internet in the economy, but simply to reignite the conversation. The issues raised here require more than a 15-page white paper to fully examine and the potential range of outcomes from them for businesses, consumers, households, and other stakeholders demand a more constructive dialogue involving all parties. This is an attempt to start that dialogue.

What We Know About the Internet

The unfortunate truth is that much of what we know about the internet is several years old, meaning that how we describe it is often incomplete and, given the dramatic rapidity of its growth and development, generally overly conservative. Yes, the internet is big. Yes, the services and products offered by it are diverse and abundant. But without a new more modern approach to our study and consideration of the sector, we will continue to discuss the past state of the sector while it speeds away through innovation and maturation.

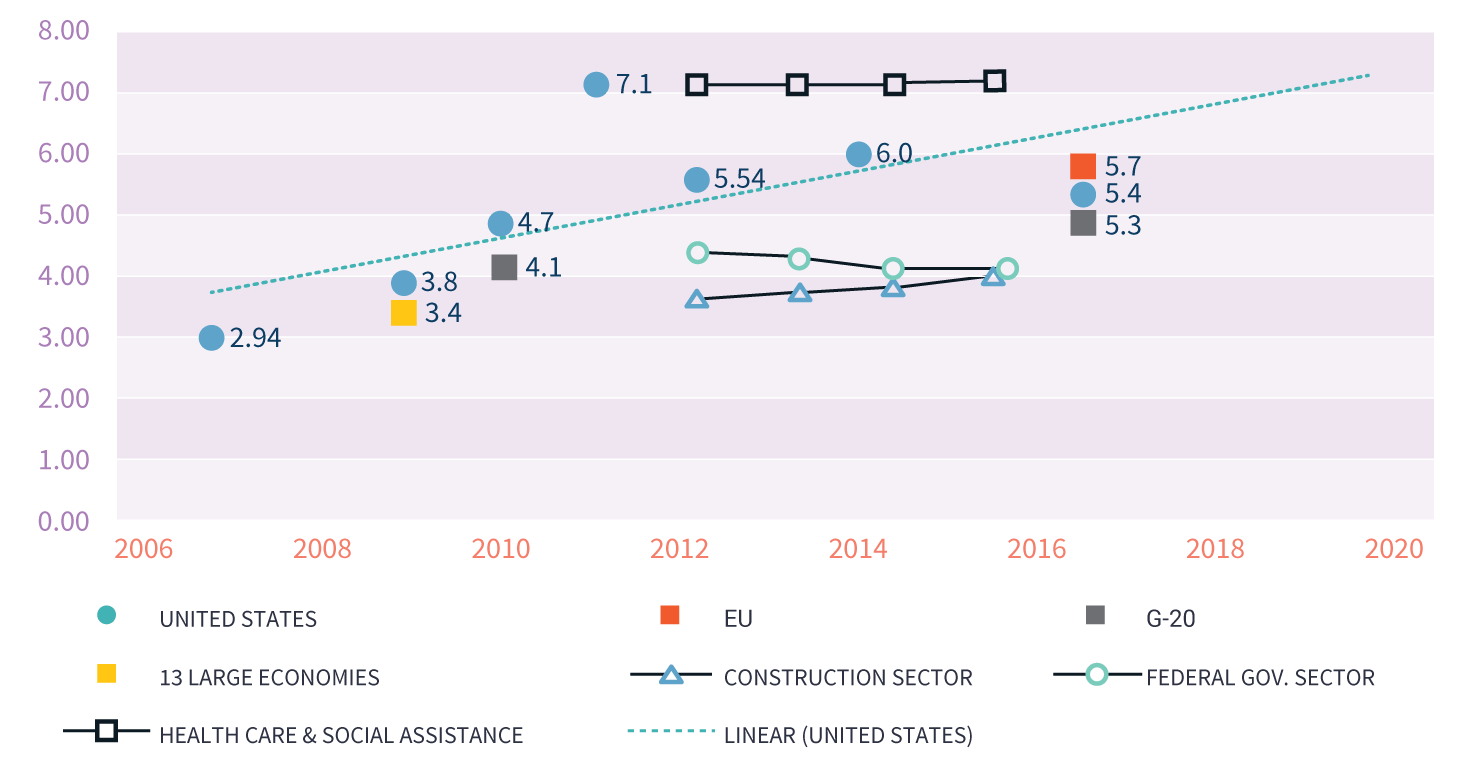

The figure of focus over the past decade has been Gross Domestic Product (GDP). Estimates show a significant and consistent contribution across methodologies that has grown rapidly over the past decade. In 2007, the sector was estimated to have contributed 2.94% of the U.S. GDP (Siwek, 2015). In 2009, the estimate was 3.8% of US GDP and in 2010 it was 4.7% (du Rausas et al., 2011; Dean et al., 2012). Using 2011 data, the Organization for Economic Cooperation and Development (OECD) estimated internet-related activities comprised between 3.2% (using conservative estimates) and up to 13.2% of US business sector value added (a component of GDP) (OECD, 2013). They also estimated a 7.1% GDP dynamic contribution to the US economy in 2011 from the internet based on an adapted methodological approach from Koutroumpis (2009).

Globally, the internet contribution to GDP is similarly high in many developed countries and in pooled estimates. One such calculation put the figure at approximately 3.4% among 13 of the world’s largest countries/economies in 2009 (du Rausas et al., 2011). More recently, a global study estimated the GDP contribution at approximately 4.1% of GDP among the G-20 economies in 2010 (Dean et al, 2012).

Jumping forward to today’s impact, two forecasts from several years ago predicted a rise in the sector’s contribution by 2016 to 5.3% and 5.7% of GDP for the G-20 economies and the EU respectively (Dean et al., 2012). And most recently, an analysis conducted in 2015 using data for 2012 found that the internet comprised approximately 6% of GDP (in 2012) in the United States (Siwek, 2015). Table 1 shows these estimates and the forecasted upward (U.S.) trajectory.

Estimates show a significant and consistent contribution [to GDP] across methodologies that has grown rapidly.

There are several things to note from these studies and estimates. First, the figures are reassuringly similar in size across different researchers and methodologies, which should help to quiet any lingering skepticism on their accuracy. Second, the estimates all either use data that are several years old or are forecasts made from five or more years ago, which highlights the need for improved and more frequent data collection and research. Third, none of the studies provide broad discussion into the full range of components that make up the internet economy1. And fourth, across the board, these studies cite the lack of and difficulty in identifying appropriate data and classifications to facilitate measurements. The paper focuses on these last two areas, which deal more directly with the conceptualization and the contributions of the internet economy.

Take for example the definition provided by OECD – it defines the Internet economy as, “the full range of our economic, social, and cultural activities supported by the Internetand related information and communications technologies” (OECD, 2008). However, rather than delving into the specific activities, their 2013 study estimating the sector’s economic contribution focuses on recapping related literature sets, such as the Information Communication Technology (ICT) infrastructure academic literature, with only limited examination of sectors and subsectors. Furthermore, they focus on providing guidance on methodological approaches highlighting three broad strategies for three different aspects of the internet economy: 1) Direct Impact measurements (through value added); 2) Dynamic Impact measurements (through GDP growth); and, 3) Indirect Impact measurements (through consumer surplus and welfare gains). This is at least likely due, apart from the general usefulness of a more robust review of methodologies, to their admission that the internet economy is an extensive and hard-to-capture sector compared to, for example, a physical infrastructure network which is perhaps more tangible.

This is indeed a common issue among researchers, policymakers, and other stakeholders and the paper argues that it is largely due to the natural tendency to consider the internet sector in the same manner as any other sector. Put differently, there is a tendency to try to simply add the ‘internet’ into the typology systems of sectors and industries that already exist, such as the North American Industrial Classification System (NAICS). This is an issue for two reasons. First, these systems have yet to fully develop a range of classification codes that is sufficient for the complete spectrum of activities carried out by internet companies. Second, even if a more robust set of codes existed, current classification systems cannot accommodate the fact that the internet sector offers both a unique subset of new products and services and a new tool for operational improvement that can be applied universally across all other sectors. The internet economy is comprised of both unique industries (e.g. apps exclusively available through the internet) and traditional industrial activities conducted through new tools and platforms from the internet (e.g. a carmaker selling vehicles online as well as through physical dealerships).

Simply placing the internet sector, as it has been measured through the reports cited above, within the current NAICS taxonomy (or other formalized system) produces a deceptively intuitive fit (see Appendix A to see where the internet ‘sector’ compares to others). Researchers can quickly provide comparators that seem appropriately matched: the internet sector contributes approximately 6% of the US GDP; it is a top-20 industry within the United States economy (in 2015); it is larger than powerhouse sectors such as Construction (3.6% in 2012), Transportation and Warehousing (2.9% in 2012), and others. All of these are true, but as several other researchers who have analyzed the internet economy have argued, the estimates are likely conservative and the comparators are not entirely appropriate.

Perhaps a more useful approach hinted at by du Rausas et al. (2011) is to consider the internet economy as a unique market (i.e. the same way we would a sovereign nation). They estimated that in 2009 the internet would have been one of the 10 largest national economies in the world, larger than Canada, Spain, and many other large developed economies, implying a global GDP contribution of over 2.1%. And while not entirely applicable, the approach does fit many of the economic activities in the internet. Recent years have seen the development and stabilization of new currencies (bitcoin and other cryptocurrencies), the development and sale of new territory (domains and sites), new production and distribution infrastructure systems (apps and network platforms), new communities and culture (social networks), and the collection and utilization of new forms of resources and commodities that can be mined and processed into economically useful items (data, APIs, and more).

The types of goods and services developed via and available through the internet should, at a minimum, be given more attention than they currently receive.

This is not to suggest that the internet should be considered a country, but it does illustrate that the types of goods and services developed via and available through the internet should, at a minimum, be given more attention than they currently receive and, as the paper argues, considered a unique class with a more sophisticated approach of incorporation.

Considering the Internet in a New Set of Lights

Extending the thought experiment to some actual data emphasizes the point. The internet and its subsectors/industries/activities (whichever of the labels you prefer) cannot simply be lumped together or thrown into the classifications that already exist. This can be seen using the subsector of mobile internet and app services, a classification that does not exist officially but which most closely falls under the NAICS codes 5171 (Wired Telecommunications Carriers) and 517919 (All Other Telecommunications) according to the US Census Bureau’s current guidance on NAICS codes. Despite this lack of official classification, the paper estimates that its contribution to the US GDP is approximately 3.11%, putting it at approximately the same size as the Automotive industry, which has historically been estimated at approximately 3.0-3.5% of GDP in the US (Center for Automotive Research, 2015). The implication is clear: internet subsectors are themselves major economic activities that should be tracked.

Leaving the formal coding aside, the paper informally defines mobile internet and app services as internet and application (those that are supported by or conducted through the internet) usage conducted through mobile devices (i.e. smartphones and tablets). Conceptually, anyone who uses a smartphone or tablet will understand what it means to use mobile internet and apps in their day-to-day life. This could involve reserving a Lyft or Uber vehicle on your phone, shopping on Amazon on your tablet while at the airport, or doing part of your tax return via Intuit while you sip coffee and wait for your friends. The volume and economic value of those activities, however, may be surprising precisely because our current classifications of economic activity are outdated. But when we change our perspective just slightly we can see how mobile internet and apps, along with the support services that make them available to hundreds of millions of mobile internet users in the United States, can be just as valuable to the US economy as the entirety of the auto sector (even when excluding the manufacture of the devices).

The paper estimates that [mobile internet & app services] contribution to the US GDP is approximately 3.11%

To calculate the value of this GDP contribution the paper draws on the three primary sources. The first is a study conducted by Christensen et al. (2015) from the Analysis Group entitled, “The Global Economic Impacts Association with Virtual and Augmented Reality”, estimating the potential economic impacts of Augmented Reality and Virtual Reality (AR and VR) technologies on behalf of Facebook. The authors developed a production model calculating the per unit dynamic contribution of smartphones and tablets and then used the results as a baseline comparator for making forecasts for AR and VR devices. The results revealed a $11,262 lifetime contribution over 5 years for each smartphone and tablet to US GDP and a 4.3 multiplier on direct expenditure (see Appendix B for full regression results from the study). While the research utilized this model for AR and VR devices, rather than expanding upon smartphones and tablets, this paper has applied it to existing data from other sources.

The second and third primary sources of data are from two reports from the Pew Research Center (Anderson, 2015; Smith, 2015) and one from the National Research Council (Lucky and Eisenberg, 2006). The Pew reports provided usage statistics and penetration rates for smartphones and tablets among the US population, which could then be applied to US Census data. These find that approximately 68% of US adults possessed a smartphone and that approximately 45% of US adults possessed a tablet in 2015. The National Research Council report provided data on the Gross Domestic Income (GDI) contributions of the traditional telecommunications sector – both for the hardware and services – in 2003 before the introduction of smartphones. The study calculated that the telecoms sector contributed approximately 3.0% of GDI in the United States in 2003 with approximately 2.6% coming from services and 0.4% coming from hardware.

Using these and some basic assumptions, this paper calculates there were approximately 274 million smartphones and tablets in the United States in 2015 and calculates a 0.85 to 0.15 split between services and hardware in the traditional telecoms sector prior to smartphone introduction. It then applies the per unit GDP contribution estimates from the Analysis Group regression model to these, yielding a 3.11% GDP contribution for mobile internet and apps. Table 2 summarizes these calculations.

[infogram id=”_/1enjFzjqgWFNlwQ3VSep” prefix=”yIT” format=”interactive” title=”Refreshing Our Understanding of the Internet Economy Table 2″]

The calculation summarized in Table 2 requires some verification2, but there is reason to believe that the estimate is solid. It draws on findings from robust research studies and is in-line with the figures estimated for the internet sector as a whole and for other comparable sectors such as telecommunications. Even if we assume an overly conservative contribution split from mobile internet and app services to the US economy (say 50% with the other 50% of value coming from their manufacture and non-internet related services), the contribution of mobile internet and app services remains at a substantial 1.84%. Most importantly, these figures demonstrate that we are overdue for a new approach to segmenting and measuring the internet economy.

Beginning the Conversation

The particulars of that segmentation are too large to detail here, but the paper generally proposes an update of existing industrial classification systems in two ways. The first is to create a new primary classification code (along with a full set of subsector classifications) for services and products that are offered exclusively through internet platforms. Two examples are mobile games that can only be played through an internet connection on a mobile device and web services such as cloud hosting. The second change is to add two unique sub-classifications to each existing industrial subsectors for 1) direct provision of traditional services and products through the internet (such as online purchases from a retail store as a sub-classification of the NAICS “Retail Trade” sector) and 2) new products and services that draw on traditional sectors offered through new and unique internet platforms (such as a ride-sharing services as a sub-classification of the NAICS “Transportation and Warehousing”).

The value of this approach lies in its recognition of the internet as a unique type of sector. Not only does the internet provide completely new and unique products and services that have only come into existence in the past decade, it also provides every other traditional product and service a medium for improved productivity. Some have labeled it as a new type of public good, others as a type of infrastructure, and other as a general purpose technology. There is truth in all of these, but they also oversimplify; the internet is singular in potential applications and should be considered correspondingly.

Of course, these changes are not easy to implement, but they are necessary and overdue. Until we change our approach to classifying and understanding the internet as an economic sector, we will continue to underestimate its impact. The Internet’s rapidly growing contribution to both domestic GDP and the economy presented in Table 1 demonstrates the scale of this necessity, and the multiple subsectors, such as the mobile internet and app services presented in Table 2, detail the variety and complexity of these contributions. Traditional approaches to conceptualizing the Internet miss many of its economic contributions to our society. Put differently, we are looking at the wrong places and at the wrong things. Until we refocus, policymakers, regulators, and the general public will continue to misunderstand the role of the internet.

Conclusion

A typical child born today will have no outstanding memory of the internet, yet he or she will develop an intuition for the internet because it will be such an integral part of life. Simply look at the ease with which a child interacts with an educational app on their parent’s tablet, swiping and clicking through systems that did not exist two years ago. Now compare that image to your own experience of trying to figure out how to use Snapchat or your parents’ experience learning about trending topics. The learning curve may have been sharp for some, but it is universally flattening.

As the internet flattens traditional barriers, we must refresh how we understand the internet in the economy. We must improve how we conceptualize it and, subsequently, how we classify its various components. The internet comprised 6% of the US GDP in 2014 and it is growing rapidly. Mobile internet and app services, just one of its subsectors, comprised over 3% of US GDP in 2015 and continues to create new products and services previously unimagined. Still our research, policies, and regulatory perspectives lag behind. It’s time to update our approach so we can begin to fully appreciate the profound economic potential of the internet.

Appendix

[infogram id=”_/8abMUwQzu0bXIXo38NBq” prefix=”jp2″ format=”interactive” title=”Refreshing Our Understanding of the Economy”]

References

Anderson, Monica. (2015). “Technology Device Ownership: 2015”. Pew Research Center. Washington, DC. Available from: http://www.pewinternet.org/2015/10/29/technology-device-ownership-2015/

Center for Automotive Research. (2015). “Contribution of the Automotive Industry to the Economies of All Fifty States and the United States.” Prepared by Kim Hill, Debra Menk, Joshua Cregger, and Michael Schultz. Alliance of Automobile Manufacturers. Ann Arbor, Michigan. Available from: http://www.autoalliance.org/files/dmfile/2015-Auto-Industry-Jobs-Report.pdf

Christensen, Laurits R., Wes Marcik, Greg Rafrert, and Carletta Wong. (2016). “The Global Economic Impacts Associated with Virtual and Augmented Reality”. White paper. Analysis Group, Inc. Available from: http://www.analysisgroup.com/uploadedfiles/content/insights/publishing/analysis_group_vr_economic_impact_report.pdf

Dean, David, Sebastian Digrande, Dominic Field, Andreas Lundmark, James O’Day, John Pineda, and Paul Zwillenberg. (2012). “The Internet Economy in the G-20: The $4.2 Trillion Growth Opportunity.” The Connected World. BCG Report. The Boston Consulting Group. Available from: https://www.bcgperspectives.com/content/articles/media_entertainment_strategic_planning_4_2_trillion_opportunity_internet_economy_g20/

du Rausas, Matthieu Pélissié, James Manyika, Eric Hazan, Jacques Bughin, Michael Chui, and Remi Said. (2011). “Internet matters: The Net’s sweeping impact on growth, jobs, and prosperity.” McKinsey Global Institute, McKinsey & Company. Available from: http://www.mckinsey.com/industries/high-tech/our-insights/internet-matters

Koutroumpis, P. (2009). “The Economic Impact of Broadband Growth: Why and For Whom?”. NBER Working Paper No. 7591. National Bureau of Economic Research. Cambridge, MA.

Lucky, Robert W. and Jon Eisenberg, eds., (2016). Renewing U.S. Telecommunications Research. National Research Council of the National Academies, Committee on Telecommunications Research and Development. Washington, D.C.: The National Academies Press. Available from: http://www.nap.edu/catalog/11711/renewing-us-telecommunications-research

OECD. (2008). The Seoul Declaration for the Future of the Internet Economy, Ministerial session. 18 June 2008. Available from: https://www.oecd.org/sti/40839436.pdf

OECD. (2013). “Measuring the Internet Economy: A Contribution to the Research Agenda”. OECD Digital Economy Papers, No. 226, OECD Publishing. Available from: http://dx.doi.org/10.1787/5k43gjg6r8jf-en

Smith, Aaron. (2015). “U.S. Smartphone Use in 2015.” Pew Research Center. Washington, DC. Available from: http://www.pewinternet.org/2015/04/01/us-smartphone-use-in-2015/

Siwek, Stephen F. (2015). “Measuring the U.S. Internet Sector”. Internet Association. Washington, DC. Available from: http://internetassociation.org/wp-content/uploads/2015/12/Internet-Association-Measuring-the-US-Internet-Sector-12-10-15.pdf

The World Bank. (2012). World Development Indicators. Washington, D.C.: The World Bank (producer and distributor). Available from: http://data.worldbank.org/data-catalog/world-development-indicators

- It should be noted that this due to the nature of these studies, which focused on establishing some baseline measurements and, more importantly, methodologies for assessing an analytically tricky sector. Illustrative examples are generally given, but detailed examinations were beyond their scopes.↩

- It makes the following assumptions: 1) that there was the same ratio of GDP contribution between hardware and services in telecoms in 2003 as there was for the GDI contribution; 2) the same ratio between hardware and services existed in the smartphone and tablet industry in 2015 as existed in pre-smartphone era telecoms sector; and 3) that the services of the smartphone and tablet markets all incorporate mobile internet and apps in some way.↩